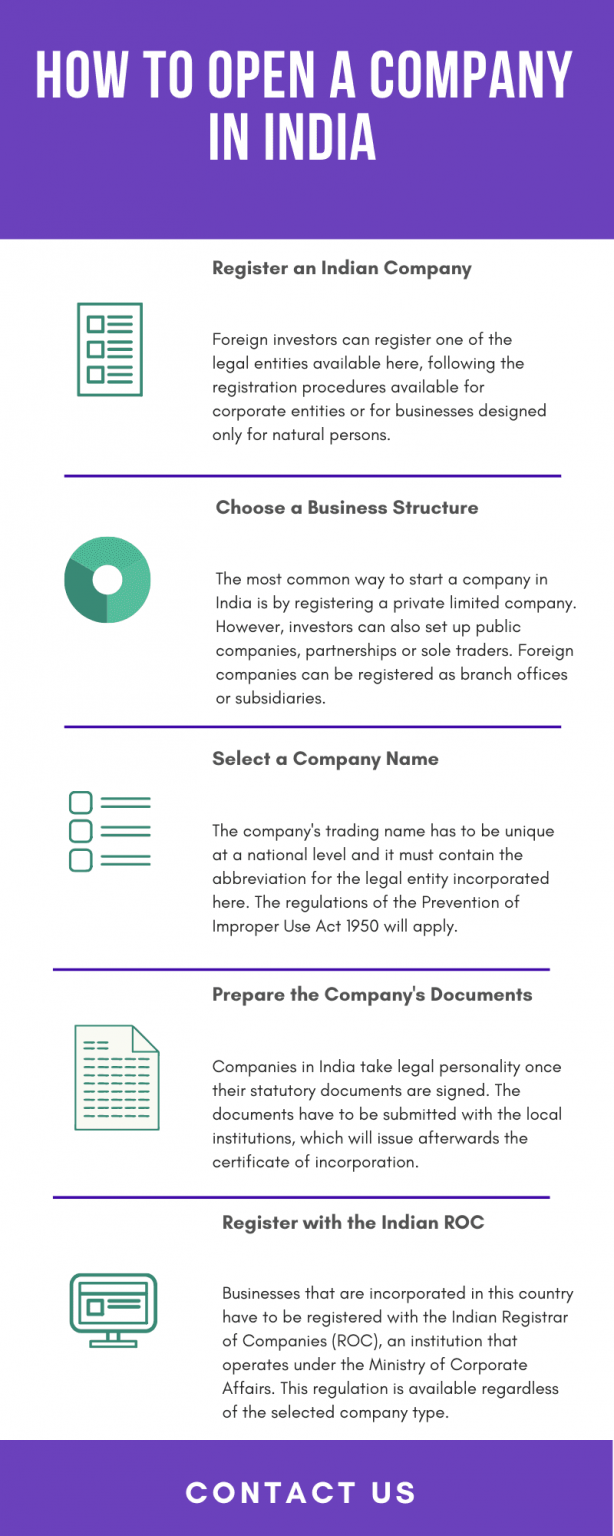

There are different types of companies being registered in India every year. The type of company you register has a major impact on your business.

When planning to start a new business, it is important to fix business structures. The organisational structure you opt would determine the taxes you shall pay, the compliance measures which must be followed, and the eligibility criteria required. Therefore, it is one of the most important decisions an entrepreneur should make. Discussed below are the different types of company registration in detail.

Different Types of Companies

According to the Companies Act, 2013, there are different classifications and types of Unique Business ideas and entities to register in India.

Types of Company Registration

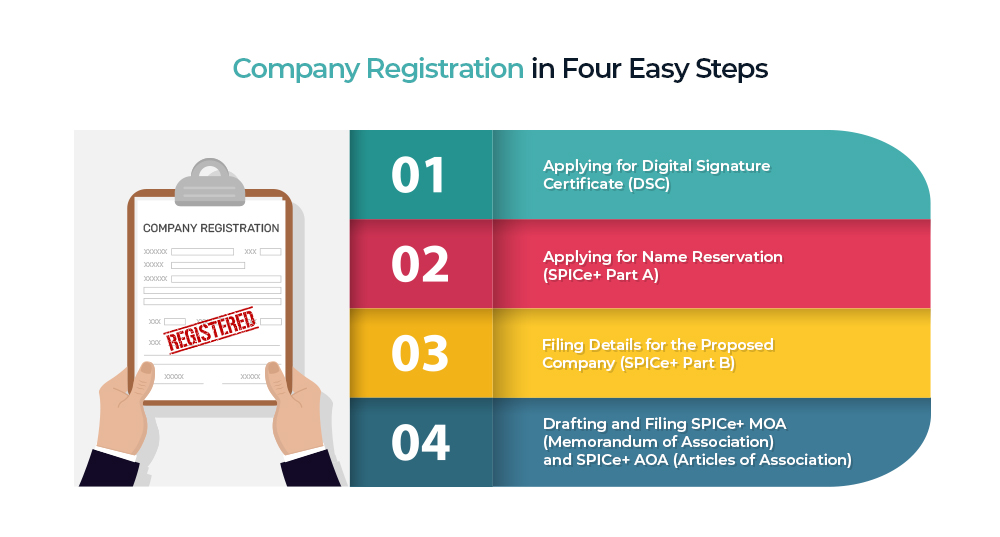

Registering the company is the basic process by which business owners establish or incorporate their company. As there are various kinds of companies in India, entrepreneurs must ensure that they choose the business type which is ...Read More

Types of Company Registration

Registering the company is the basic process by which business owners establish or incorporate their company. As there are various kinds of companies in India, entrepreneurs must ensure that they choose the business type which is according to their operations. In India, the Companies Act, 2013 allows for 7 different structures to establish a business:

Private Limited Company

Public Limited Company

Partnerships

LLP Registration

One Person Company

Sole Proprietorship

Section 8 Company

Private Limited Company

Private limited companies are businesses which require Private Limited Company as private entities. In these companies, a group of shareholders will distribute the liability amongst themselves in order to protect their personal assets. The capital of these business types is the total of all shares are held by each member of the company. Also, the personal and business assets of the members of these business will considered as separate, thus, allowing for a better protection and security. The shares of such company will not be publicly traded or transferred.

According to the Companies Act, 2013, to be eligible for this type of business registration, following conditions must be fulfilled:

At minimum two to a maximum of fifteen directors should be appointed

At least one of the directors of the company must be an Indian resident

From two to a maximum of 200 shareholders or members of the company should be there.

Authorised capital fee amounting ₹1 lakh minimum

Must have a registered office address in India.

Types of Private Companies

Limited by shares: In private limited companies, the liability of the members will be limited to the normal value of the shares owned by them

Limited by guarantee: In this case, the liability of members will be limited by the amount each member will contribute or guarantees to pay in case the company gets bankrupt.

Public Limited Company

A public limited company is one whose shares could be purchased by the general public as well. In these companies, no limit has been implanted on the number of shares which could be sold or traded. As the shares of the company are listed on stock exchange, they could be freely traded, making the shareholders part-owners of the company as well. In order to Convert the Private Limited Company to a Public Limited Company, such company would need to obtain a certificate of registration from ROC before starting their business operations.

According to the Companies Act of 2013, the following criteria should be fulfilled in order to register as a public limited company:

Three directors at minimum

At least one of the directors should be an Indian resident

At minimum seven shareholders with no bar on the maximum number of directors.

An authorised capital fee of at least ₹5 lakhs

The company must have a registered office address within India.

Partnership Firm

In case of partnerships, the operations will be handled by partners who agreed on the role and their share in the profits. The functions, duties, powers, and number of shares owned would be clearly mentioned in the partnership deed. These businesses will be governed under the Indian Partnership Act of 1932.

Partnership firms can function even with or without a licence until they have a valid and registered partnership deed. But, most partnerships do register as it provides them additional rights and benefits. Eligibility criteria to form partnership firm are:

There should be at least 2 partners, and maximum members can be 10

The firm must have a registered office addressed in India

There must be a registered partnership deed signed by all partners.

Limited Liability Partnership

Popularly referred to as LLP, the limited liability partnership is the nw kind of company in India. It enjoys a separate legal status, distinguishing between personal and business assets, and granting the entrepreneurs with a limited liability protection. In LLPs, the liability of each partner will depends upon the number of share capital.

To set up an LLP, following criteria must be met with:

Minimum authorised capital is ₹1 lakh

At least one of the partners has to be an Indian resident

At the very least two partners are necessary to establish a LLP, while no condition is applied on the maximum number of partners

At least one individual partner, if the rest are corporate bodies

No requirement for shared capital since each partner must have an agreed contribution.

One Person Company

One Person Company is the newest type of company registration being permitted in India, which is great for small businesses like Agriculture business. It is the best option for individuals who plan to start a business own their own. An OPC has separate legal status; entrepreneurs would get the benefit of liability protection even without having a partner.

As the company would involve a single individual, it will be easy to incorporate and regulate. In order to register an OPC, following criteria is required to be fulfilled:

Minimum allowed capital is at least ₹1 lakh

The individual should be a natural Indian citizen as resident herein

A nominee must be appointed by the Promoter during the incorporation

Financial businesses are not incorporates as OPC.

Sole Proprietorship

A sole proprietorship is where a single individual handles the running of the business. The company and the owner could be considered as a single entity, thus making them solely responsible for profits and losses of the company. Since registration includes the name of the owners, tax filings and accounting reports would also bear the name of the owner, leading to unlimited business liability.

It is one of the simplest form of business to set up and operate. This plan would be preferred by home business owners and small business owners with Supermarket Business Plan, as it does not require much investment or compliance.

Section 8 Company

Commonly referred to as non-profit organisation, Section 8 companies are established with objective of charitable purposes. The purpose behind establishing such enterprises is promoting arts, science, literature, education, caring for the needy or protecting the environment. Also, the profits generated by these companies are used to achieve these objectives, and the members will not take dividends for themselves.

Following conditions must be fulfilled in order to register a Section 8 company-

At least two shareholders must be there

A minimum of two directors who could be shareholders as well

At least one of the directors must be an Indian resident

There is no limit on the minimum capital required

The company should have a registered office address in India.

Conclusion

Selecting the right company structure for your business is important as would allow your enterprise to operate efficiently and meet the required business targets. Every business in India has to be registered as a mandatory legal compliance. It is, thus advised to seek legal advice from an experienced advocate.

Why Sharks of Law ?

Single Platform- Sharks of Law offers you affordable and easily accessible legal services are offered for all types of legal issues at a single platform.

Team of lawyers- Sharks of Law offers you a highly qualified professional team of advocates for different legal requirements.

Specialised advice- We offer you required guidance and advice for your legal issues.

Highly qualified advocates- Sharks of Law offers you a team of brightest and most driven lawyers who have years long experience in their field.

Easily accessible legal services- Sharks of Law believes that legal assistance should be easily accessible as one may need it at any time of the day, hence you may contact us through any medium you are comfortable with.

Consult with experienced Lawyers across expert areas

Take a look at the glowing reviews and success stories from some of our happy customers to see how (CompanyName) can help your business achieve its goals.