Cheque Bounce notice is nothing, but an intimation to the issuer that legal action would be taken by the cheque beneficiary for non-payment of cheque amount.

Cheque bounce is caused due non-payment of the amount as a result of the lack of balance in the account. In order to ensure recovery of the amount, prompt action should be taken. Cheque Bounce is a serious offence punishable by both imprisonment and fine provided under Section 138 of the Negotiable Instrument Act. As provided under the Negotiable Instrument, the bounced cheque must be presented within 30 days from the date of dishonouring of the cheque.

What is a Cheque?

A Cheque is a type of “bill of exchange” which is payable on demand. Issuer of the cheque is called ‘drawer’ while the person in whose favour a cheque is issued shall be referred ...Read More

What is a Cheque?

A Cheque is a type of “bill of exchange” which is payable on demand. Issuer of the cheque is called ‘drawer’ while the person in whose favour a cheque is issued shall be referred to as a ‘drawee’.

A Cheque, is nowadays used in almost all transactions including those of repayment of loans, payment of salary, bills, fees, etc. A huge amount of cheques are processed and cleared by the banks on a daily basis. Cheques are issued in order to ensure a secured amount of payment. Hence, in order to secure the rights of the related parties, the law has provided a proper procedure to be followed in case of cheque bounce, which starts with sending a legal notice.

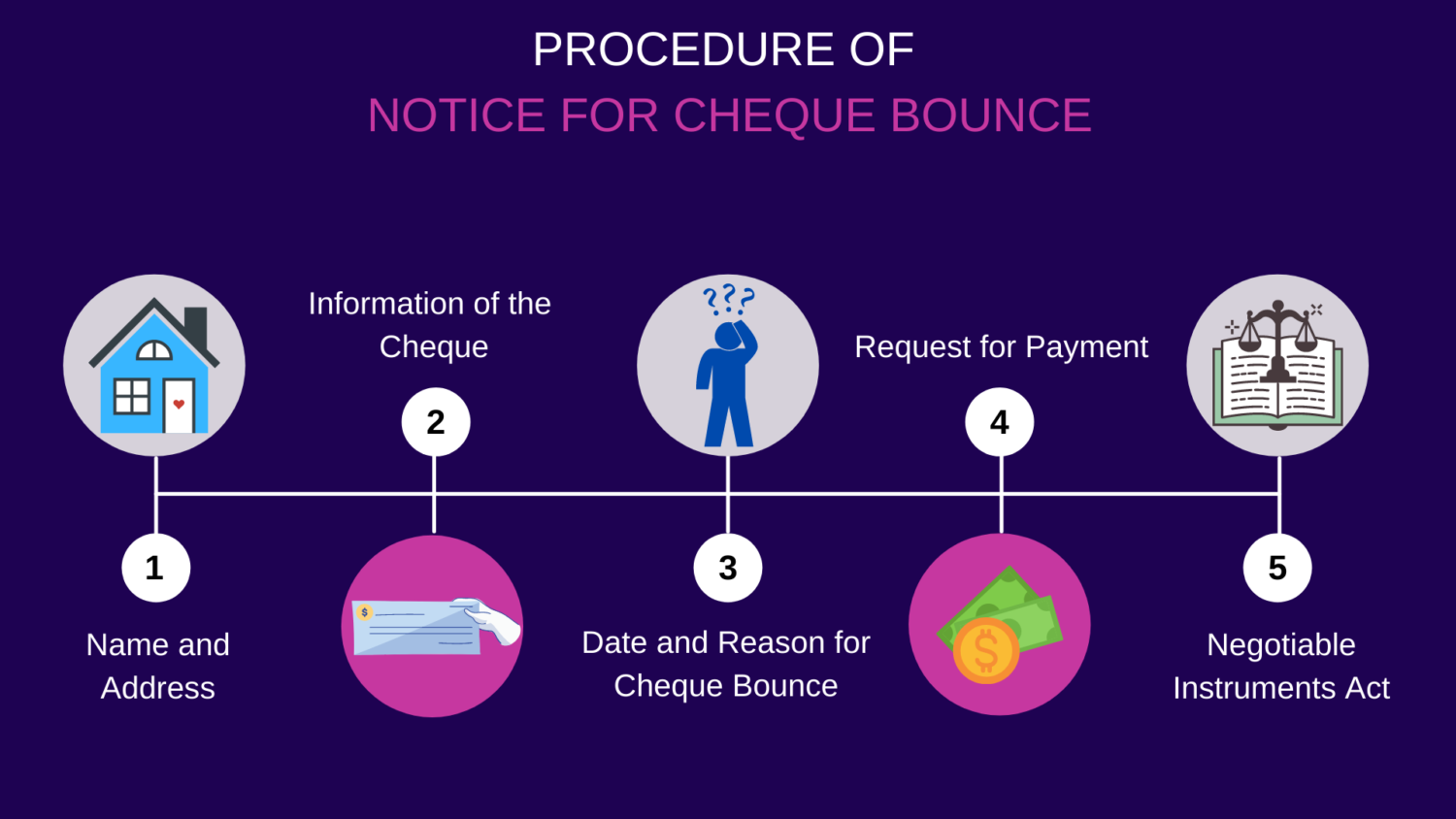

Before serving a notice about cheque bounce to the person who has issued cheque, following information is required-

What are the important points which are require for a Valid Cheque Bounce Notice?

When can a notice for Cheque bounce be issued?

Sending a Cheque Bounce Notice

A cheque bounce notice must be sent through a registered post with an objective of recording the issuing date of the notice. Cheque beneficiary must retain one copy of the letter and the other copy should be delivered to the cheque issuer through a registered post.

Why and When Cheque Bounce Notice should be Issued?

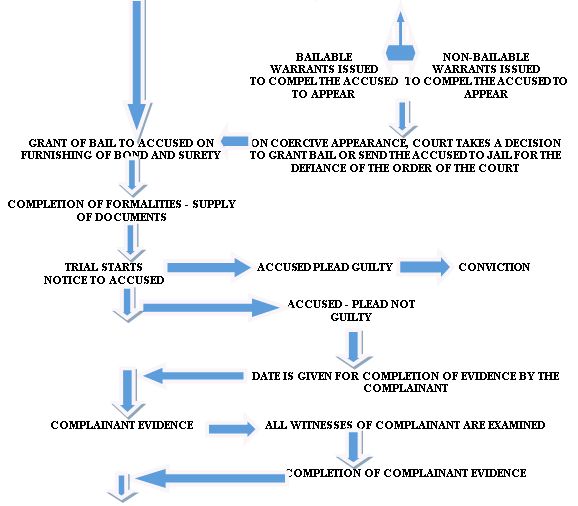

Initiating Legal Action in case of Cheque Bounce?

What is the Procedure of Cheque Bouncing?

Punishment and Penalty

After having received the complaint, the court would issue summons and hear the matter. When found guilty, the defaulter will be punished with monetary penalty which could be twice the amount mentioned in the cheque or an imprisonment for a term which could be extended up to two years or both.

In case the drawer makes payment of the amount mentioned in the bounced cheque within 15 days from the date of receipt of the legal notice, then drawer has not committed any offence. In order to seek proper legal advice or draft the required notice, you should contact an experienced advocate.

Why Sharks of Law ?

Easily accessible legal services- Sharks of Law believes that legal assistance should be easily accessible as one may need it at any time of the day, hence you may contact us through any medium you are comfortable with.

...Read lessConsult with experienced Lawyers across expert areas

Take a look at the glowing reviews and success stories from some of our happy customers to see how (CompanyName) can help your business achieve its goals.