An impartial assessment of an entity's financial accounts is offered via statutory audits. An audit opinion in the form of an audit report is the outcome of a statutory audit conducted by a competent practitioner following the preparation of statutory accounts. According to an unqualified audit opinion, the financial statements present a true and fair picture. A qualified audit opinion will be issued if the auditor determines that the accounts do not present a truthful and fair picture or that there are additional issues that need to be reported.

According to the Companies Act of 1956, a company's profit and loss statement and balance sheet must both adhere to the necessary accounting standards and provide a "true and fair view" of the company's situation as of the end of the fiscal year. The auditor is assigned to determine whether appropriate books and accounts, as required by law, have been maintained and whether they accurately depict the situation.

In a general meeting, each company that complies with sections 224, 225, and 226 of the Companies Act, 1956, appoints an auditor. Section 227 lays out an auditor's responsibilities and authority concerning conducting an audit of a corporation. It is the auditor's responsibility to make sure ...Read More

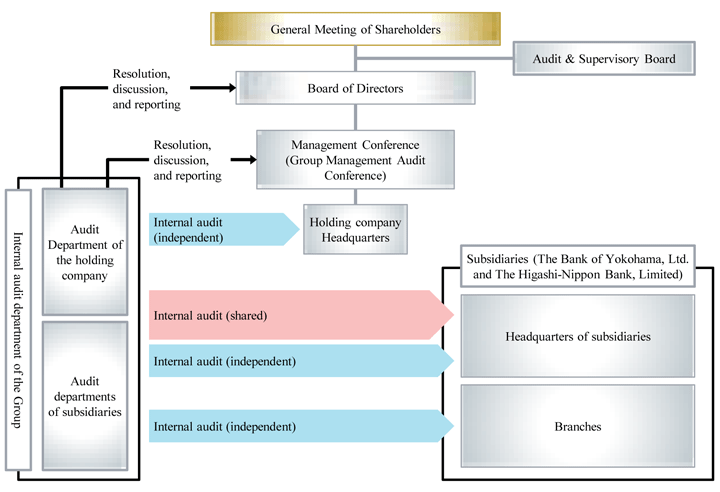

In a general meeting, each company that complies with sections 224, 225, and 226 of the Companies Act, 1956, appoints an auditor. Section 227 lays out an auditor's responsibilities and authority concerning conducting an audit of a corporation. It is the auditor's responsibility to make sure that the company's shareholders' rights are protected. The shareholders as a group have a fiduciary responsibility to the auditor. The purpose of the audit is to safeguard the interests of the shareholders, and the auditor is supposed to review the directors' accounts to enlighten the shareholders about the company's actual financial situation.

Obligations of Statutory Auditor:

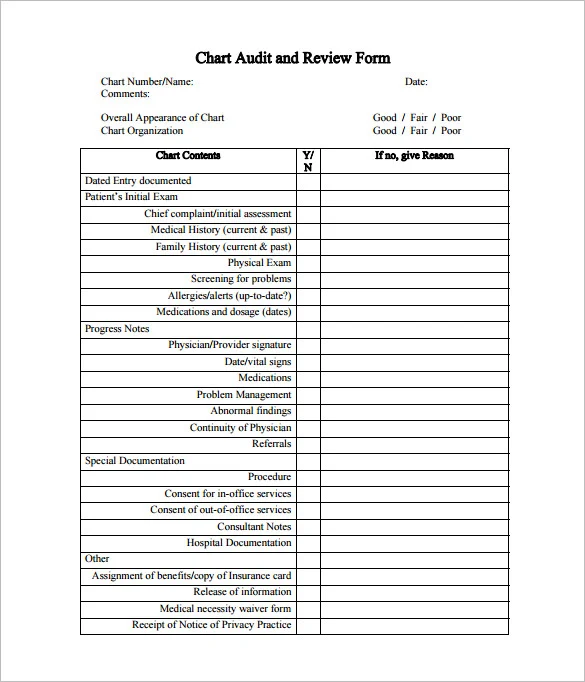

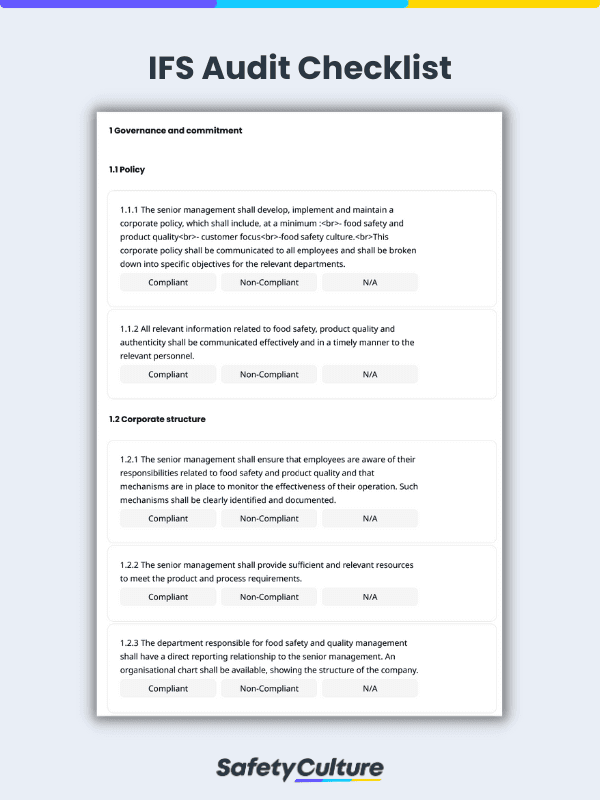

· In a general meeting of the company, the auditor is required under Section 227 to report to the members on the books and accounts, balance sheets, profit and loss accounts, vouchers, and any other documents that were examined. In addition, the auditor is required by law to report to the shareholders on the appropriateness, in his judgment, of the company's bookkeeping practices.

The report should also indicate:

1. Whether the auditor believes the company has provided all appropriate books of accounts and other documents adequate for the audit, or not; and

2. Whether he has obtained all information and explanations, which are to "the best of his knowledge and belief" necessary for his purpose.

3. Whether the balance sheets and profit and loss accounts match the company's books of accounts and returns.

4. Any observations or remarks regarding the way the business is run, particularly if they could be detrimental to the business.

· An auditor must be fully aware of his ethical duties to third parties. Additionally, since his reports are likely to be trusted, he must take great care and skill to ensure that the information provided reflects the actual and accurate condition of events and is clear of all ambiguities.

Penalties:

The Companies Act's Section 227 penalizes auditors who willfully violate Sections 227 and 229 by requiring them to pay a fine. If an auditor fails to perform their obligations due to carelessness, they will be obliged to compensate the investors or members of the firm for any losses they may have suffered. The auditor will be held tortiously accountable if he commits deception. Claims may be made if the auditor missed mistakes or deceptions that could have cost the business money.

Fraud by Auditor

The following four elements must be proven for the auditor to be found guilty of fraud:

The statement he signed was false in reality;

The auditor knew the statement was false or acted carelessly in ignorance of its truth;

The statement was made with the intention that the other party take action on it; and

The other party experienced harm as a result of acting in reliance on it.

In addition, anyone who knowingly makes a false statement on a return, report, certificate, balance sheet, prospectus, statement, or other document faces criminal punishment under section 628 of the Companies Act, 1956. Additionally accountable is the auditor who falsifies in his report that the balance sheet provides a true and fair picture of the business's financial situation.

The company's shareholders primarily rely on the integrity and skill of the auditor who was chosen to review the books and validate the balance sheet. To ensure that no transaction is unlawful or improper, auditors must carry out their tasks with the utmost care, skill, and alertness. If they have any reason to suspect a transaction is unlawful or wrong, they must notify it. As a result, the auditor has to certify things that he does not think to be genuine and use reasonable caution before accepting something that he certifies to be true.

How can Sharks of Law assist you?

Consult with experienced Lawyers across expert areas

This company's audit services exceeded expectations, showcasing exceptional professionalism and precision in every aspect.

Read-more

Arpit

Team Leader

Take a look at the glowing reviews and success stories from some of our happy customers to see how (CompanyName) can help your business achieve its goals.